snohomish property tax rate

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11. First half tax payments made after that date will need to include any interest or penalties.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

What is the property tax rate in Snohomish County.

. If you have questions you can reach out to our staff via phone email and through regular mail as well as visit our customer service center on the 1st floor of the Administration East Building on. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. When summed up the property tax burden all.

Every year property taxes are levied on all types of non-exempt real. State Laws Revised Code of Washington RCW Pertaining to Property Taxes. Heres what you need to know about paying your Snohomish County property taxes by phone.

For a reasonable fee they will accept monthly payments and pay your tax bills when due. Contact Evergreen Note Servicing online by clicking here or by phone at 253-848-5678. For every 1000 in property value an average of 3009 is paid in property taxes in Snohomish County.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local.

The Department of Revenue oversees the administration of property taxes at state and local levels. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions. Snohomish County collects on average 089 of a propertys.

The first half 2022 property taxes were due April 30th 2022. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Though not uncommon for.

To pay by phone youll need to call the Snohomish County Treasurers Office at 425. Property taxes have increased across Snohomish County due voter approved tax measures and school levies that will go in affect in 2020. For comparison the median home value in Snohomish County is.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Box 1589 Snohomish WA 98291-1589. In our oversight role we conduct reviews of county processes and.

Property Tax Exemptions Email the Property Tax Exemptions Division 3000 Rockefeller Ave. The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median. MS 510 Everett WA 98201-4046 Ph.

Explore important tax information of Snohomish. Learn all about Snohomish County real estate tax. Snohomish WA 98291-1589 Utility Payments PO.

Levy Division Email the Levy Division 3000 Rockefeller Ave.

Snohomish County Property Tax Exemptions Everett Helplink

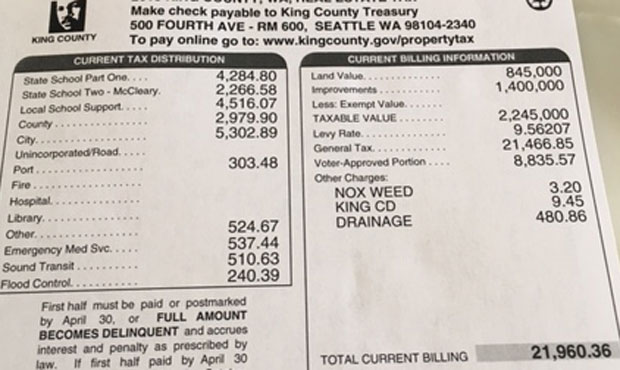

King County Taxes May Force 38 Year Capitol Hill Neighbor Out Of Town Mynorthwest Com

Taxes Incentives Doing Business In Stanwood Wa

Council Connection Good News Lower Property Tax Rate In 2015

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Washington Property Tax Calculator Smartasset

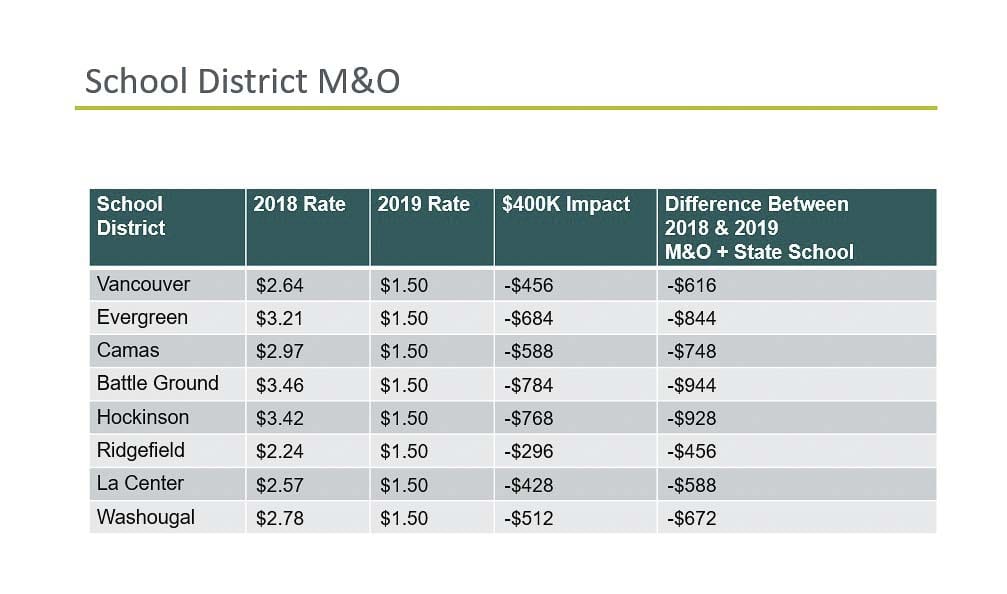

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

Graduated Real Estate Tax Reet For Snohomish County

Spokane Co To See Highest Property Tax Increase In Its History Krem Com

Homeowners Worry As Snohomish County Property Taxes Rise Over 34 In 5 Years

Washington Property Tax Calculator Smartasset

Property Taxes And Assessments Snohomish County Wa Official Website

Property Tax Residential Values By County Interactive Data Graphic Washington Department Of Revenue

Spokane Co To See Highest Property Tax Increase In Its History Krem Com

Homeowners Worry As Snohomish County Property Taxes Rise Over 34 In 5 Years

News Flash Snohomish County Wa Civicengage

Taxes And Incentives Everett Wa Official Website

Homeowners Worry As Snohomish County Property Taxes Rise Over 34 In 5 Years